The middle class “American dream”, at least since World War II was founded on the idea of the home not only as lodging but as investment savings. My dad (a common wage-earner employed as a depot agent with the Milwaukee Road Railroad) counseled that it was a good idea to buy the largest house you could afford “because a house will appreciate in the long run.” I still remember my parents sitting at the kitchen table pencilling out what they could afford to buy, calculations that finally resulted in the momentous purchase of a two bedroom, one bath, single family dwelling priced at $15,600. That was a price that was somewhere between two and three times my dad’s union negotiated railroad annual salary. That purchase, and the mortgage that came with it, wasn’t just a dwelling, it was a major portion of my family’s net worth at the time.

Work hard to scrape together enough money for a downpayment, put money down on the biggest home you think you can afford, find a mortgage lender, and jump on the economic treadmill. For at least a half century this path was considered the way to financial security and the middle class—an opportunity brought to you by the banks, the developers, and the homebuilding industry. Short on cash? Take out a second mortgage or a “reverse mortgage” on your home piggybank!

It worked pretty well for decades. (That is with the major exception of 2008, when the banks, lending institutions, and regulators, in their relentless quest to make money on the backs of others, bankrupted many who had invested in the home as a vehicle to wealth.) Paying on a mortgage to own the biggest home one could stretch to afford was the prime savings plan for most Americans aspiring to the “American Dream” of upward social and economic mobility. Many folks running on this treadmill of mortgage payments have little left over each month to invest in retirement savings, stocks, and bonds.

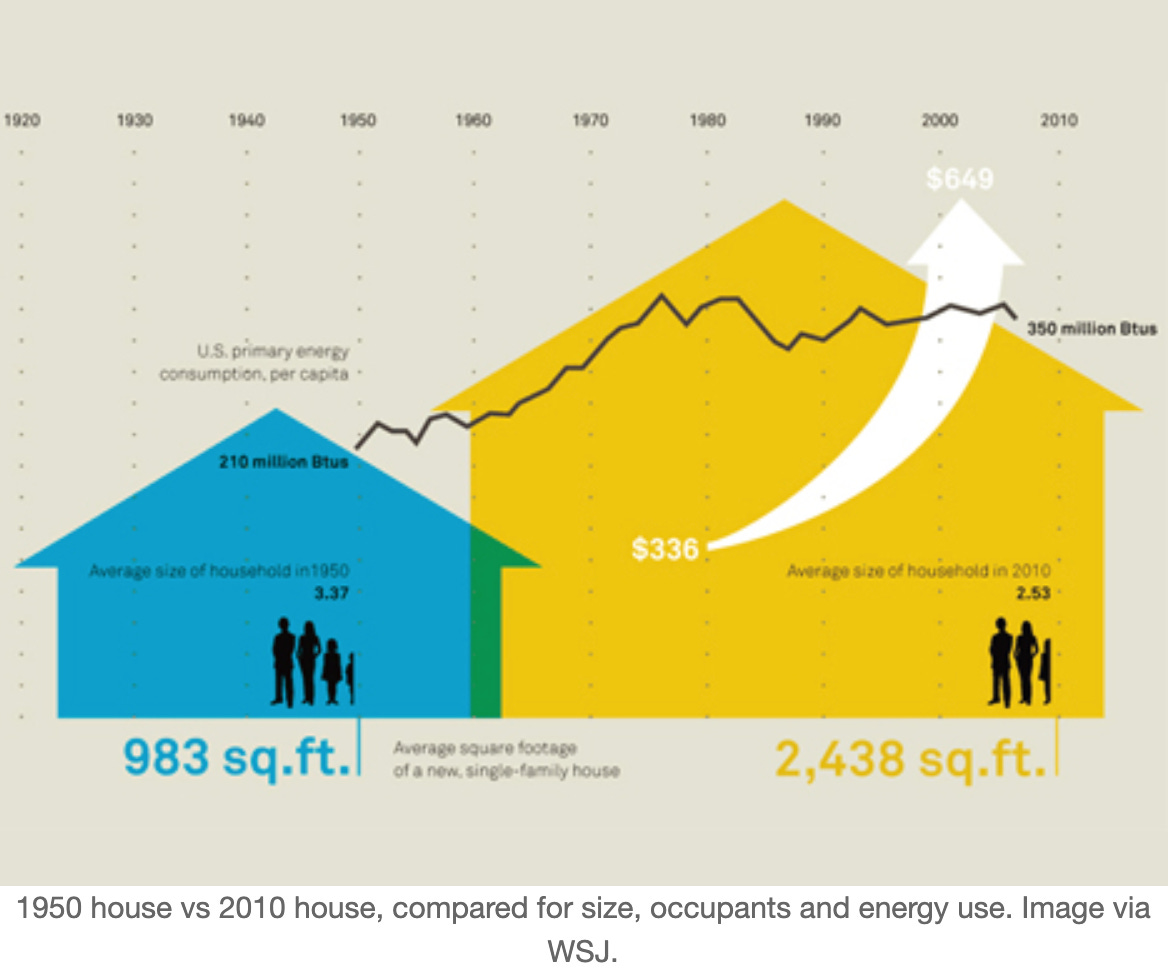

In that same half century, even as average family size has roughly halved, the average square footage of a new single-family home has ballooned by a factor of 3 (as has the associated carbon footprint).

Meanwhile the income gap has vastly widened over the same time period that the cost of housing has risen. In 1950 the median (not average, but median) home price was 2.2 times the average yearly income. Today the median sales price of houses sold in the U.S. is $404,700 while median real personal income is just $35,805, so the median home price today is more than 10 times the median income.1 Is it any wonder why cities with the hottest housing markets (and concurrently rising rental prices) are experiencing homelessness at levels not seen since the Great Depression? The relationship is clear.

If you’re one of those folks living in the Inland Northwest with a stable job and a low interest 30 year mortgage on a home you purchased ten years ago, life is good (at least until you sell at the inflated price and then try to buy something else). If, on the other hand, you’re making even $20/hour ($40,000/year) and you lack any familial wealth to fall back on, you might be holding on by the skin of your teeth to pay rent and stay housed, much less thinking about buying a home.

For developers, builders, and realtors the greatest profit margins are in building and selling tract and high end housing. Neither offers housing a local average worker can afford. Neither contributes much to alleviating homelessness, in spite of local election claims made by realtor/developer PACs. Both types of housing are sold to folks moving here from places where they’ve been able to sell their home at an inflated price to someone even better off—and then use that money to bid up home prices in Spokane and North Idaho. Homelessness goes unaddressed, the developers profit, home prices soar, and locals, some of whom do the actual building, are priced out of a place to live.

The part of the American Dream that specifies a large home with a bigger mortgage as the stepping stone to family savings and the middle class has become steadily more unattainable. Those who are still able to mount the mortgage treadmill in hope of a better life find the financial system rigged—as many found in the crash of 2008—or they find, like they did in Detroit, that when jobs move elsewhere, their mortgage exceeds the value of their home. Home values are neither portable nor fungible the way stock and bond investments usually are. If your home value is your only savings you’re on thin financial ice.

The home-mortgage-based stepping-stone to wealth developed in the aftermath of World War II. That was a time when many a monumental familial fortune was depleted. The home value playing field was leveled by high estate taxes and marginal income taxes running as high as 90%. In that financial milieu housing prices were driven by demand from the bottom up—not from the top down, as they are today.

The paradigm of pursuing the American Dream by building more McMansions and pricey tract homes spread out on agricultural land is unsustainable and only serves to further enrich the already wealthy. A change in tax structure from the Republican and neoliberal trend of the last forty years (since Reagan) is required to shift this paradigm before the pitchforks come out (if they aren’t out already…)

Keep to the high ground,

Jerry

If you dig into these statistics note that quoted numbers are for individual income. In 1950 home mortgages were commonly taken on by single income families. Today, qualifying for a mortgage often requires the income of at least two adults. The numbers quoted today are often “household”, not individual income figures. That difference underlines how unaffordable housing has become over my lifetime.