Vote!, Short-Selling Trap, 2008

If you haven't yet, go find your ballot in that pile of junk mail, vote YES on the Spokane Public School's (District 81) replacement levy and either get it in the mail today or deposit it a ballot drop box. Your ballots must be in by or postmarked by (no guarantee there) Tuesday, February 9 at 8PM. For more of my thoughts on the subject see Republicans, Schools, and Taxes.

Puzzled by the news blip around the run-up in stock price of a company called "GameStop"? I was. Judd Legum in his Popular Information on January 28th puts it all in context in his The merry adventures of Robinhood. I've copied it below. There are echoes in this piece of the outrage many felt surrounding the crash of 2008 and the bailouts that followed. I have little sympathy for those who make vast sums of money taking bets with other people's money. Some of them seem to be getting their comeuppance in the current melee. The story is entertaining, satisfying--also disquieting and worrisome in a world that already feels unsteady:

Hedge fund manager Gabe Plotkin is ridiculously wealthy. In November, Plotkin purchased a $32 million mansion in Miami with "nine bedrooms, twelve full bathrooms and four half bathrooms." To preserve his privacy, he also paid $12 million for the house next door. Plotkin also recently bought a "large chunk" of the Charlotte Hornets.

How did Plotkin get so rich? The hedge fund he founded, Melvin Capital Management, has generated fantastic returns. Since its start in 2014, Plotkin's firm has averaged returns of 30% per year. Melvin Capital Management now has more than $12 billion under management and Plotkin collects 30% of the profit as his fee.

Plotkin generates huge returns by taking big risks. One of Plotkin's strategies is short selling stocks he believes will decrease in value. The way you short sell a stock is by borrowing it from someone else, selling it and, hopefully, repurchasing it at a lower price later. When the short sale works out, the drop in share price becomes profit for investors like Plotkin.

Short sales can be very profitable, but the strategy comes with extra risk. When you purchase a stock for $100, the worst that can happen is that it goes to zero and you lose all your money. When you execute a short sale for a stock at $100 and instead the price increases to $300, it will cost you another $200 to close out your position.

Plotkin and his colleagues in the industry had no problem with these risks when they were generating enormous profits. But 2021 has presented challenges. On January 22, the Wall Street Journal reported that Plotkin's firm had lost 15% of its value in the first three weeks of the year. The losses were a result of the firm's extensive "short book, or array of bets against companies." Then things got much worse.

A particular problem for Plotkin and other investors was short selling GameStop, the video game retailer. GameStop sells video games and related equipment in retail stores. Many hedge funds and others bet against GameStop because modern gamers are more likely to download their games and shop online. The pandemic hasn't helped GameStop's business prospects.

But the bets against GameStop, which turned a profit and reduced its debt load in 2019, were very heavy. There were more GameStop shares sold short(71.2 million) than total shares available (69.7 million). This is possible for technical reasons, but the volume illustrates just how many people were betting on GameStop's situation to get worse.

Further, not everyone believed GameStop was a lost cause. Ryan Cohen, the former CEO of online pet retailer Chewy, believes that GameStop can be reimagined as a force in online retailing. Cohen started buying a lot of stock and earlier this month, Cohen and two of his colleagues from Chewy were named to the GameStop board of directors.

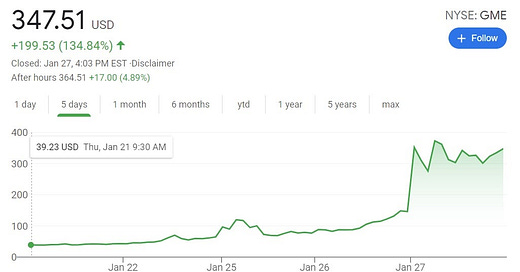

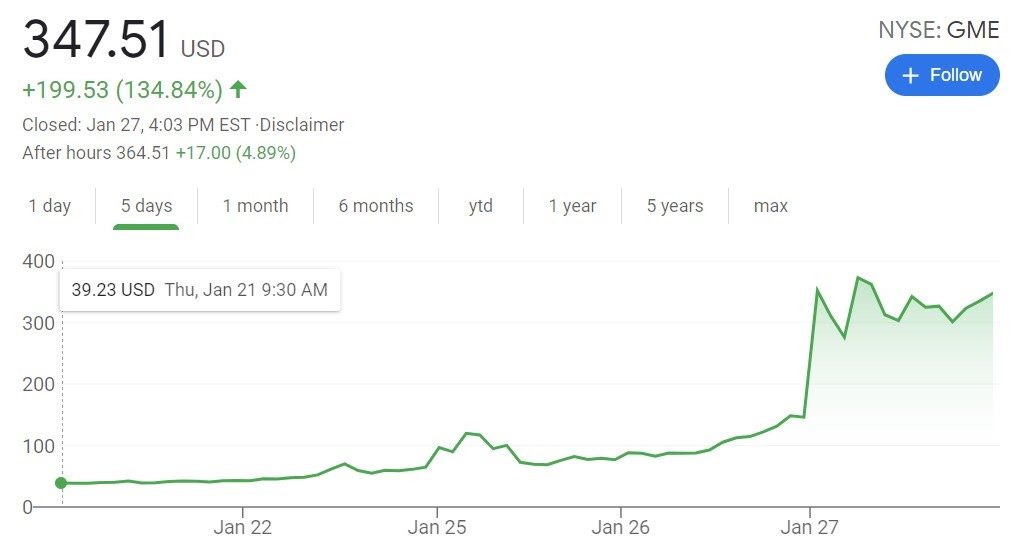

2020 has seen a boom in retail trading, especially from no-cost apps like Robinhood. Some of these traders congregate on a Reddit forum called r/wallstreetbets. Users of that forum began buying GameStop stock. Some believed in Cohen's vision, some wanted to stick it to the Wall Street short sellers, and some just wanted in on the fun. Late last week, GameStop stock was trading at under $40. On Wednesday, the stock closed at nearly $350.

How did some people hanging out on Reddit drive this kind of increase? Their stock purchases are only one component of GameStop's dramatic rise. When a stock that is sold short rises dramatically, lenders start to ask for their stock back. That means short sellers have to buy GameStop to close their position, driving the stock up further. Also, some of the buyers from Reddit and elsewhere were not directly buying GameStop stock but were buying call options — the right to buy GameStop stock at a higher price. But as the stock goes up, the firm on the other side of these trades purchases more GameStop stock to hedge its position. All three of these factors created a feedback loop that caused GameStop's meteoric rise on Tuesday.

The dynamic was not limited to GameStop. Other stocks targeted by short sellers, including AMC and Blackberry are seeing large gains. The dynamic has panicked the Wall Street establishment, which began taking steps on Thursday to curtail the trading of Redditors and other retail investors.

Ostensibly, these actions were done to save small investors from themselves. But is that what's really going on? Or do Wall Street titans just not like it when regular people use tactics normally reserved for "experts" to make money?

Plotkin's bailout

Plotkin went quickly from running one of the best-performing hedge funds in the industry to serious financial peril. But he was rescued with a $2.75 billion cash infusion from two other hedge fund titans, Steve Cohen and Ken Griffin. Cohen was Plotkin's former boss at SAC Capital Management. SAC shuttered after the firm pled guilty to insider trading and paid $1.3 billion in fines. Cohen was not personally charged. Griffin runs Citadel LLC, a hedge fund which he found in 1990. Longtime Popular Information readers may remember Griffin for purchasing the most expensive home in America.

In exchange, Citadel and Point72, the successor firm to SAC, own an undisclosed stake in Melvin Capital Management. The companies now all have an interest in Plotkin getting out of this jam and resuming his work of bringing in massive profits.

The trio appears to be getting some help.

Schwab and TD Ameritrade restrict retail traders

On Wednesday, Schwab and TD Ameritrade, two large retail trading platforms with a common owner, took the highly unusual step of "restricting trading" on GameStop, AMC, and other stocks. TD Ameritrade said it was acting to protect its customers and itself. "In the interest of mitigating risk for our company and clients, we have put in place several restrictions on some transactions in $GME [GameStop], $AMC and other securities. We made these decisions out of an abundance of caution amid unprecedented market conditions and other factors," TD Ameritrade said.

The SEC announced it was “actively monitoring the on-going market volatility in the options and equities markets.” Reddit’s r/wallstreetbets was temporarily set to private, supposedly because there were too many new members to moderate the content. A related discussion board on a service called Discord was shut down.

Limiting trading of these stocks may make it easier for hedge fund managers like Plotkin — and his new investor Griffin — to navigate out of this predicament. Less buying of GameStop stock or call options will put downward pressure on the stock, making it easier for short sellers to unwind their position.

Griffin, through Citadel, does a lot of business with retail trading platforms. When retail investors make a trade, it is frequently handled by Citadel. The Financial Times reported that "Citadel Securities accounts for 40 of every 100 shares traded by individual investors in the US, making it the number one retail market maker." Specifically, Citadel is "a big buyer of customer trades from the leading US retail brokerages such as Charles Schwab and TD Ameritrade." Citadel pays companies like Charles Schwab and TD Ameritrade tens of millions of dollars for the right to handle this "order flow." Citadel, in turn, profits from the "spread" — the difference between the price to buy and sell the stock.

CNBC freaks out

On CNBC, many people were freaking out about the Game Stop situation. Host Scott Wapner, for example, said that the rise in GameStop's price was evidence of problems with the "integrity of the system."

Investor Chamath Palihapitiya pushed back. "Just because you were wrong, doesn't mean you get to change the rules. Especially because when you were wrong, you got bailed out the last time. That's not fair," Palihapitiya said.

Palihapitiya did not say who he was talking about, but he could have been talking about Griffin. In 2008, when the financial crisis hit, Citadel had massive exposure as a securities lending counterparty with AIG. If AIG went under, Griffin would be out hundreds of millions of dollars. But that never happened. AIG received a $182 billion taxpayer bailout. As part of this, AIG was able to pay counterparties full value for its otherwise worthless contracts. Citadel ended up with a $200 million cash infusion.

Citadel benefited even more from the massive bailout of lenders it relied on to stay liquid. Griffin admitted that, one Friday during the crisis when he left work and realized that if Morgan Stanley did not open on Monday, Citadel would go under. But Morgan Stanley did not go under because it received a $100 billion bailout from the federal government.

But now, twelve years later, we are told it is retail investors that are irresponsible and do not understand how things are supposed to work.

Support Accountability Journalism

Keep to the high ground,

Jerry

P.S. The news that appeared after I wrote this disclosed that the platforms that were being used to bid up the share price of GameStop (and thereby punish some hedge fund managers like Mr. Plotkin had clamped down on small investors taking part--and that produced a general uproar and shouts of "Unfair!" This story is not over...